Do You Have To Pay Tax On Gambling Winnings In Ireland

However, if you receive off-the-record winnings, these are still taxable. You will have to report them as other income when filing your taxes, and these will be taxed along with the rest of your income according to your filing status and tax bracket. You may also have to pay state income tax on your sports betting cash, depending on where you live.

- Do You Have To Pay Tax On Gambling Winnings In Ireland 2019

- Do You Have To Pay Tax On Gambling Winnings In Ireland 2020

- Do You Have To Pay Tax On Gambling Winnings In Ireland Uk

- Do You Have To Pay Tax On Gambling Winnings In Ireland Today

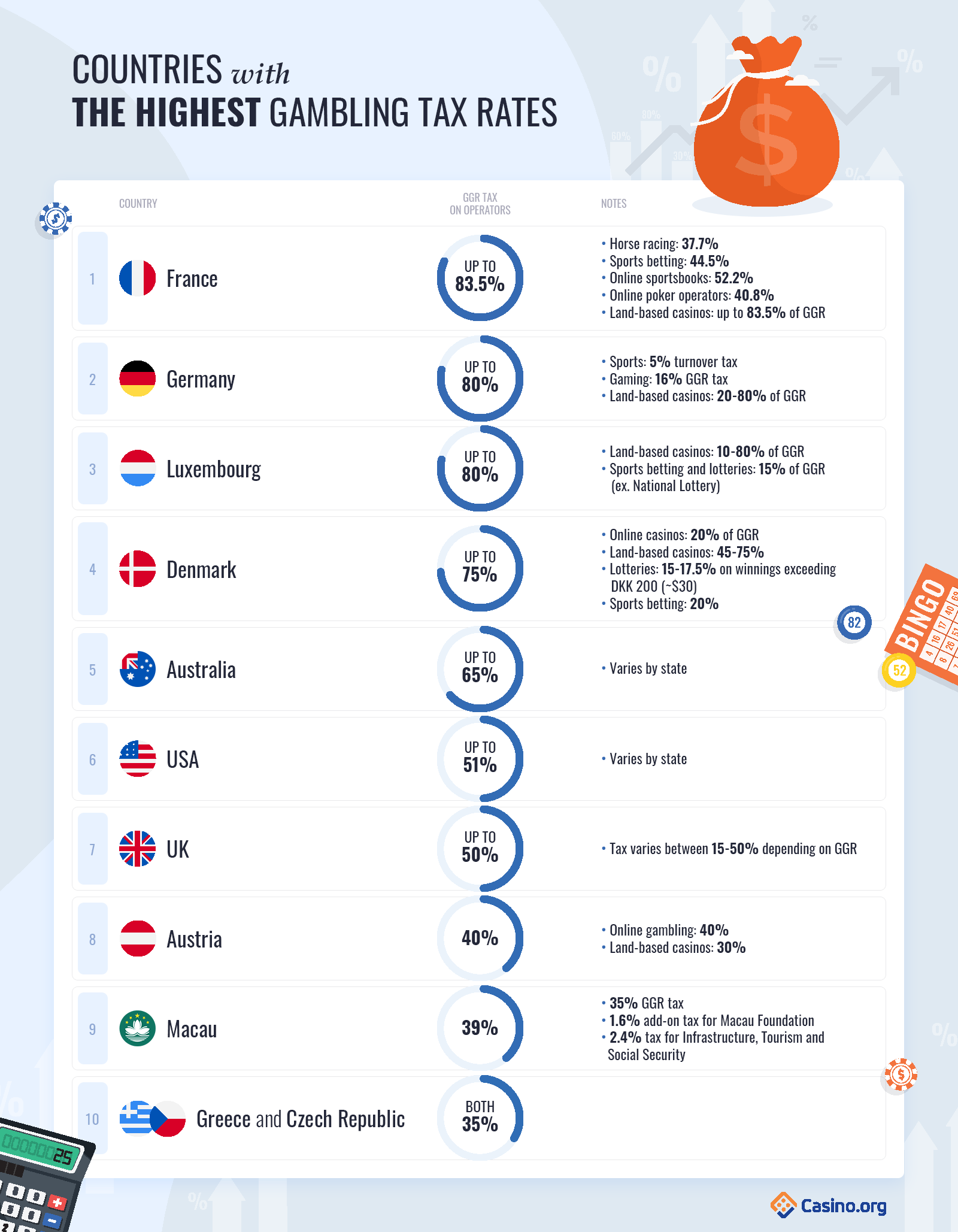

But even if you don’t receive the form, you’re still required to report all your winnings as “other income” on your tax return. “All cash and non-cash gambling winnings are taxable and should be reported as ‘other income,’ ” says Patrick Leddy, partner at Farmand, Farmand & Farmand LLP. However, if you gamble and win but you have a bigger source of income and don’t rely on professional gambling to pay the bills, you won’t be taxed. In other countries, like Kenya and Ireland, players aren’t taxed on their winnings, but bookies must pay a certain percentage of taxes on the total bets or winnings they record.

To quote the famous historical know it all Benjamin Franklin, “There are only two certainties in life: death and taxes”. As a gambler though you maybe don’t stop to think about where tax would enter the equation when you place a bet. Believe me it is there; gambling is just as much a taxable service as is having a pint in your local boozer and whilst they may have the edge on most punters, the bookies certainly don’t beat the taxman.

So, where exactly in the transaction does this taxation take place and is tax due on winnings? Let’s take a look at that, as well as the various changes that have taken place over the years.

Do You Pay Tax on Any Gambling Winnings You Make?

In short, the answer to this question is no, you don’t have to pay any tax whatsoever in the UK on any gambling winnings at all. This includes all types of gambling from winning a couple of quid on the fruit machine down the pub to winning the jackpot in the National Lottery, or from landing a 5,000/1 acca on the horses to cleaning up at online poker.

Anything you win, regardless of how you won it all goes straight into your pocket and the government can’t touch it. What’s more, whilst all the bounty is yours, you don’t need to declare any winnings to HMRC via self-assessment or any other means.

The only notable exceptions to this rule are if you win this money abroad, with a foreign operator, say the local lottery while on holiday in Spain. This would then be subject to local tax laws of whichever country you are in, so it is worth checking to see what those laws are before you play.

Note, however, that this isn’t applicable to bets made online, so you don’t need to worry, for example, if you win a bet with your regular UK bookie whilst you are on holiday. Equally, if you make a bet with a UK-licensed betting site that is owned and/or operated from elsewhere, UK tax laws will still apply.

One thing that may be worth noting though, is that should you win a large amount on a bet while in Europe, and it pays out in cash, you may have difficulty bringing this amount home with you. At the time of writing, 10,000 euros is the maximum limit for the amount of cash you can take abroad.

The only other way in which the taxman would be able to get his hands on any of your cash would be if you were to give any of the winnings away. We are in danger of moving off topic here but gifts may be subject to certain taxes. There are ways and means to minimise this but if you are lucky enough to win a decent sum and wish to give some away to friends or family, the best bet is to seek help from a financial advisor.

Point of Consumption Tax – Current UK Law

When a member of the public enters a bookmakers on the high street and places a bet on that three-legged nag in the 3:30 at Doncaster, not only are they hopefully going to win a hefty sum of money, but they are also indirectly contributing a total of 21% of their stake towards the UK government.

However, thankfully, this is not something us bettors have to worry about. Those making the bets do not have to think about about tax calculations or decide whether they wish to pay tax on their stake or their winnings (as used to be the case until 2001 when betting duty was ended). Indeed, they are not directly taxed at all on either.

Tax upon bets made in bookmakers is simple, the government takes 21% of all the gross profits of bookmakers. Whilst this isn’t a direct tax on punters, it does mean that if you lose a £10 bet then effectively £2.10 will go to HMRC, meaning that even if you lose at least you can take consolation that at least you are helping the NHS!

This doesn’t affect your bet in any way, however, for all intents and purposes you still have a £10 bet riding with the bookies, and any payouts will be based on this figure, so, as said, the punter pays absolutely zero tax when betting in the UK.

This point of consumption tax (POC) was introduced in 2014, and was created to close the loophole of online gaming companies from being able to move abroad to a tax haven, such as Gibraltar, and pay little or no tax even if the bettor was based in the U.K. There are various gambling-based taxes implemented by HMRC, including the General Betting Duty (GBD), Remote Gaming Duty (RGD) and Pool Betting Duty (PBD).

More details about these can be found at HMRC. The key point about them, however, is that they are now based on where the person making the bets is based, whilst previous taxes had focussed on the location of the bookmaker.

Before the introduction of consumption tax law, the UK government were still able to tax any bets made in betting shops, at the point of supply. But as online gambling was becoming more and more popular, the government was losing more and more money as gaming companies and bookmakers moved their base of operations to take advantage of point of supply tax laws in places such as Gibraltar, where the tax charged can be as low as 1%, as opposed the 21% charged in this country.

As HMRC themselves say, “From December 2014, the government reformed GBD, (apart from spread betting), Pool Betting Duty (PBD) and Remote Gaming Duty (RGD) so that these duties apply on a ‘place of consumption’ basis”. In other words, remote gambling operators pay UK gambling duty on their gross gambling profits from UK customers no matter where in the world the operators are located.

The government amended the law in 2018, to be enforced by 2019, increasing the level of the tax from 15% to 21% in certain instances (although there had been fears it would be 25%). The precise nature of the differing taxes is rather complex with various rates applicable, ranging from 3% for financial spread bets right up to 21% for RGD. These have been the applicable levels since 1st April 2019.

Once again though, the only thing you as a punter really need to remember is, well, nothing. You don’t have to pay any gambling taxes. Nice!

How Have Gambling Laws Changed?

The first bookmakers started to appear in the UK in the 1960s following a change in the law, although they were always present in the background beforehand, operating semi-legally at best. Back then, betting was only supposed to take place at race tracks at the totalisator board.

In the 1950s, there were lots of “underground” gambling houses and street operations, including some operated by people who would go on to establish UK betting giants, such as Fred and Peter Done who created and still own Betfred. These early incarnations were illegal and as such not paying any tax on their income.

But then in the 1960s, a time of great liberalisation in general and in particular when it came to betting, the government woke up and realised that they weren’t getting a cut with these illegal dens. Obviously not wanting to miss out on their slice of the pie they legalised the high street bookies as we know them today.

In 1968, a good few years after high street shops were legalised, the tax on betting was introduced and was set at 6.75%, with bookmakers paying this to HMRC. The bookies passed this tax on to the punters at a rate of 9% and this could be paid by the bettor either upon making the bet as an increase in their stake (so a £10 bet would actually cost £10.90) or they could opt to pay the tax on their winnings.

The upside to deciding to pay tax on the winnings was of course if you didn’t win then you didn’t have to pay, and the bookies had to take the hit. But on the downside if you did win then obviously the winnings would be of a higher amount than that of the stake and therefore the 9% would equate to a higher amount.

This system worked just fine, until around the turn of the century when new advances in technology would change the way betting was being done. Then-Chancellor, Gordon Brown, announced that from the 1st January 2002 punters could bet tax-free, with bookies instead facing a 15% tax on their profits. This was an attempt to stop them moving off-shore, and in fact to repatriate the many that already had.

The tax was ultimately unsuccessful though, with big business, as often seems to be the case, finding ways to work around the ethos of the rules, whilst simultaneously operating, legally, within them. It is felt that the removal of betting duty caused a huge spike in gambling but it wasn’t until the change to a POC tax that the exchequer really regained its slice of the pie.

The Horse Racing Levy

Earlier we talked about how the high street bookies were legalised in the 1960s and this was primarily to enable the government to control and tax gambling in the UK.

It was felt that a knock-on effect of the new legislation would be that as people no longer had to go to race meets in order to place a bet, attendances at courses would fall. This drop in gate receipts and other associated incomes generated from people going to the horses, such as beverage sales, hospitality and so on, could prove very damaging for the sport.

So, in 1961, to try to compensate for this, it was decided that British bookmakers would pay what is known as the horse racing levy. While not a tax in the strictest sense, the bookies still pay to this day a fee of 10% of gross income over the £500,000 exemption amount and this legislation also covers online and overseas bookmakers, as well. This wasn’t always the case and only changed recently due to an amendment to cover shortfalls in the levy.

This money goes directly to the Horseracing Betting Levy Board (HBLB), a “UK statutory body that was established by the Betting Levy Act 1961” and falls under the remit of the Department for Digital, Culture, Media and Sport. The funds generated are used to support various aspects of horseracing, although in many ways the initial motive of compensating for the losses incurred when the high street bookie was born is no longer valid.

The levy funding goes towards prize money for racehorse owners, upkeep of stadia, veterinary science and racehorse breeding initiatives among other things and in the last financial year brought in £78 million to go towards these initiatives.

Contributions to Responsible Gambling & Other Financial Support

As well as paying into the Levy Board, many bookmakers also contribute financially in other ways. Their huge involvement in sponsoring events in a range of sports may not exactly be altruistic but it certainly supports horse racing, football and snooker to name just three. Bookies also contribute to other causes and issues but chief among these is responsible gambling.

Once again, critics may well argue that such donations are chiefly to avoid mandatory charges and further taxation … and they may well be right. None the less, it is worth noting that in addition to the significant tax betting companies pay, the major UK players pay a voluntary levy of 0.1% of their profits to a fund that helps betting charities and support groups.

In 2018, this raised more than £10m for these causes and under increasing pressure from the government and ant-gambling groups, in 2019 bookies including Coral, William Hill, Ladbrokes, bet365, Betfair, Paddy Power and Sky offered to increase that to 1% over a five-year period, a move which could lead to donations of around £100m per year or more.

How Much Tax Does Betting Generate?

As well as the cold, hard bottom line of tax paid by bookmakers to HMRC, the industry supports thousands of jobs around the country. All of these employers generate tax, of course, whether they work in a betting shop, customer service call centre or kiosk at a football club, not to mention the ancillary jobs supported in the various sports. There are no accurate figures for the total contribution of the entire industry but we do know how much bookies contribute directly.

So, how much does the UK government make from gambling? Well according to statistics, the treasury collected just short of £3bn in 2018/19 alone, with a growing proportion of this income coming from remote gaming. The total take was £2.74bn in 2016/17 and that was more than twice what it had been a decade earlier.

There was a major leap in betting and gaming tax receipts between the years 2014/15 and 2015/16, which reflects the taxation changes made by the government. This saw the contribution of the industry jump from £2.12bn to £2.67bn, an increase of 26%.

Aside from that though, the trend for the amount of gambling tax is also showing a gradual increase as every year passes, perhaps to do with the fact that gambling is now so easily available, with people who one generally wouldn’t see in the bookies now able to play from the comfort of their own home.

Also, with new and innovative ways to bet now, such as cashing out, specials markets, such as the number of throw-ins and corners, or even betting on a horse to not win a race, there are no shortage of things to bet on. Reality TV, politics and just about every aspect of life can now be wagered on and this can be done on mobile and tablet, anywhere, at any time, whilst online casinos, poker and bingo are further options.

Ever more markets and options are likely to become available too, so prospective gamblers are probably more likely to spend a bit more money than they used to when you could just bet on which team would win and you had to go to a dingy shop to do so! All in all, gambling is a growing business, and the government certainly doesn’t want to miss out on their cut of the takings!

Gambling is fun. Taxes are not. Unfortunately, the two have to go together for anything to happen.

The truth of the matter is that for states like Michigan, the only real reason to legalize any form of gambling is the opportunity for tax revenue. Whether it be to pay for schools, roads, or some other unspecified project, most governments are always on the lookout for a new revenue stream.

Paying any taxes stings, to be sure. However, it’s important that you know how and when the taxman might come when you visit one of Michigan’s casinos. So, here is a guide for how taxes apply to Michigan gambling.

What is taxable in Michigan?

Throwing money around in a casino rarely seems like an official transaction. Whether you win or lose, the final disposition of your chips can often feel like a stitch in time.

Unfortunately, it’s not. All winnings that you realize in a casino are taxable as income, both on the state and federal levels.

So, you should be reporting those wins on your annual tax returns. Though many people scoff at the notion of reporting cash income to the government, it counts the same as income from a check or direct deposit in the eyes of the taxman.

Failure to report your gambling income could, in theory, land you in hot water with the Internal Revenue Service (IRS) or the state of Michigan’s tax office. In practice, those entities are unlikely to audit someone over a few hundred or thousand dollars, but that doesn’t mean that they can’t or won’t do so.

Also, please take note that non-cash winnings, like cars, boats, or other objects that you may win at a casino are subject to taxes too. The value that has transferred to you because of the win has increased your financial position, and the government wants its share of the loot. As a side note, game show prize winners have to do the same thing.

What taxes will I have to pay in Michigan?

Now that you’ve steeled yourself to the reality of giving away a portion of your sweet winnings to the government, you may be wondering who and what you’ll be forced to pay. As indicated earlier, you will be compelled to pay percentages to both the IRS and the state of Michigan for your wins there.

The IRS, for its part, will demand that you fork over 25% of your winnings to the feds for your troubles. This rate applies to wins of any size, so even if you win just a dollar, you’ll still need to throw a quarter at the taxman.

In addition, Michigan law requires that you pay an additional 4.25% to the folks in Lansing for having played in their casino. Even though the casinos themselves are the main wellspring of tax income for the state lawmakers, gamblers do not escape unscathed.

For smaller wins, you’ll essentially be on your honor to report your gambling winnings to the appropriate authorities. As stated earlier, it’s not legal just to stick the money into your pocket, but there’s no mechanism or watchful eye to force your compliance as you exit the casino.

That lack of oversight extends to wins up to $5,000. However, at that point, the casino itself is bound to collect 25% on the government’s behalf before it releases your winnings to you. Give the cage your name and Social Security number, and your tax bill will be settled before you leave the property.

Obviously, losing 25% off the top is a kick in the teeth, but please don’t get any ideas about simply withholding your name and SSN. As it turns out, anyone who refuses to provide their information (for any reason) will be subject to an additional penalty of 3%.

Neither option is good, but bear in mind that the casino is not going to keep a cent of that money that it withholds. So, you might as well go along with it and live to fight another day.

If I never win $5,000, will I ever have to pay taxes upfront?

If you’re not a high roller, the idea of ever reaching the federal threshold for casinos to report wins might seem far-fetched. After all, if you usually bet in $5 or $10 increments, it’s quite unlikely that you’ll realize a win that exceeds $100, let alone $5,000.

So, you may be wondering if you’d ever have to worry about the feds ever knowing that you were gambling. Unfortunately, there are some other scenarios in which the casino might have to report your win to the IRS before handing you the proceeds from your hard-fought victory.

A casino must report a win to the IRS with Form W-2G if any of the following events occurs:

- The total winnings, or combined bet and profit, on a slot machine exceed $1,200.

- A player’s keno profit on a game is more than $1,500.

- A poker player wins more than $5,000 in a tournament.

- A game’s profit is more than $600 and is thirty times or greater than the bet amount.

Now, filing this form does not mean that the casino has to collect from your winnings automatically. However, since the government will soon be aware of your win, it would be foolish to omit it from your return. So, make sure to keep your copy of the form for your records.

The bottom line is that if you have a memorable win in a casino, it’s quite likely that the government wants to remember it, too.

How do I report my winnings?

It’s understandable that you might feel disappointed about having to pay taxes on your winnings. Nevertheless, in most cases, you’ll bite the bullet and decide to file. So, here’s how to do that.

As is the case for essentially anything to do with the IRS, there are forms to fill out. The first thing to do is report the income on the IRS Schedule 1, which is the form for additional income and adjustments to income.

On that form, look for Line 8 in Part I, which is entitled “other income.” Here is where you will list your winnings and their source. “Gambling” or “casino” are fine for explaining from where the money came in most cases, although you can be more specific regarding the casino and date if you’re worried about attracting attention.

Once you’ve entered the information onto your Schedule 1, you’ll need to put the same total onto line 7a of your regular tax return. You will then be able to add the winnings into your overall taxable income.

Do You Have To Pay Tax On Gambling Winnings In Ireland 2019

By the way, your Schedule 1 is also the place to list various types of deductions, like certain business expenses or student loan interest payments. So, make sure that you don’t miss out on all the different ways to knock down that taxable base.

Can I report gambling losses in any way?

Of course, gambling comes with the inherent chance of losing. However, you could understandably think that it seems unfair that the IRS only cares about your winnings. You may wonder if there’s a way to claim gambling losses on your taxes.

As it turns out, you can.

The IRS provides Schedule A as a form to claim various deductions. Although there’s no line expressly for gambling losses, you can list your setbacks in Box 16 – Other Itemized Deductions to claim them.

Now, there are two rules that go along with claiming casino losses on your tax form. The first, and most important, is that you cannot claim losses in excess of your claimed winnings.

So, if you list $1,000 in gambling winnings on your Schedule 1, the maximum that you could claim as losses on your Schedule A would be $1,000. If you had a bad year at the casino (as many of us do), the IRS does simply allow you to write off the loss as a deduction against your taxable base, unfortunately.

Do You Have To Pay Tax On Gambling Winnings In Ireland 2020

The other rule is that you must be able to prove your losses in some kind of meaningful way in order to claim them. It is vital that you keep records, receipts, and other documentation to show the losses, or the IRS might not accept the deduction as valid.

After all, that might be a handy way to offset your winnings from the year and avoid taxation, so the IRS has to be sure that you took the beating you claim to have suffered. The chance that the agency will take a harder look at you will increase as the dollar amount goes up, so if you’re a bit of a high roller, it’s a good idea to keep a paper trail for yourself.

Do You Have To Pay Tax On Gambling Winnings In Ireland Uk

If you’re thinking that record-keeping might be a pain, you can possibly make things easier by using your loyalty or membership card at your casino of choice when you play. Since they award you based on your play, they keep records of your play. It shouldn’t be too difficult to acquire a copy of your history from the casino.

Do You Have To Pay Tax On Gambling Winnings In Ireland Today

For your Michigan tax return, it is not possible to claim any kind of losses as a deductible expense. However, the state does allow you not to report the first $300 you win on bingo, poker, or other games from your total household expenses.

Do I have to pay taxes if I don’t live in Michigan?

It’s pretty clear that you have to pay taxes to Michigan if you’re a Michigan resident. However, you may be wondering if you’re still on the hook for the taxes if you’re just visiting from out of state.

Unfortunately, you are still bound to pay taxes to Michigan for your gambling win as a nonresident. As is often the case, there’s even a form for that. Worse yet, you will also have to report your winnings on your return for your own state, assuming that your state requires an income tax.

However, there are a couple of bits of good news. First of all, the states nearest Michigan (Illinois, Indiana, Kentucky, Minnesota, Ohio, and Wisconsin) have reciprocal agreements with the Great Lake State regarding earnings that you incur in Michigan. If you live in one of those six states, you are not required to file a nonresident return in Michigan.

The other ray of sunshine is that there is, in fact, a tax credit that you will be able to claim on your home state’s return that will offset the taxes you paid in Michigan on your winnings. So, even though you had to fork over to a state in which you don’t live, you don’t have to pay double tax on the windfall. Although states are happy to collect tax revenue, they correctly realize that having to pay tax twice on the same win might lead citizens to decide it’s not worth the effort to play.

Do I have to pay taxes if I’m part of a group?

In many things, there is strength in numbers, and gambling is no exception. It’s not uncommon for a group of friends to pool their money so that they can roll a bit higher than they would individually. Whether they’re throwing in for a slot machine or on a lottery ticket, groups of people can often find themselves with a claim to a significant amount of winnings.

Unfortunately, taxes remain one of life’s surest things, and group wins are subject to taxation just as much as individual wins. As expected, there is a form for that.

If your group of friends scores big, you will need to fill out IRS Form 5754 to report the winnings for tax purposes. One of the group will have to designate himself or herself as the primary winner, and the other members of the group will have to note the share of the prize that they are claiming. So, if you hit it big with your buddies, you might need a calculator.

Once you’ve got the form filled out, send it to the IRS. If the win occurs at a casino, casino management might want a copy of the form for its own records, too.